Source: cnbc.com

For a long time, American space exploration was a closed circle: There was just one customer, the U.S. government (NASA) and a handful of giant defense contractors. Then in 2008 Elon Musk’s SpaceX put the first privately-financed rocket into orbit, Jeff Bezos’ Blue Origin promised private flights, and space was suddenly a lively market with companies vying to put satellites and humans into orbit.

A decade later hundreds of start-ups have flocked to the space sector, bringing sophisticated technologies that include artificial intelligence, quantum computing, phased array radar, space-based solar power, “tiny” satellites and services that could not be imagined just a few years ago.

Space Angels, an early stage investor that also tracks investments in the sector, reported that venture capitalists invested $5 billion into space technologies in the first three quarters of 2019, putting the year on track to be the biggest year yet, with Blue Origin pulling in $1.4 billion from Bezos. Since 2009, said Chad Anderson, CEO of Space Angels, investors have poured nearly $24 billion into 509 companies.

Anderson said that SpaceX triggered the transformation not just by offering competition to NASA but publishing its prices for a launch. Before that revelation, space was really an opaque market, making it difficult for potential competitors to price their products. “It’s been a really big decade for commercial space,” said Anderson.

The largest amount of venture capital still goes into the most fundamental task: putting satellites into orbit. Anderson says 89 companies have received funding for so-called small-lift launch vehicles. These are companies promising to put payloads of up to 2,000 kilos (4,400 lbs) into low Earth orbit. Their focus is a new generation of small satellites such as those used by OneWeb and SpaceX’s StarLink, which promise broadband internet access in even the most remote parts of the world by deploying “constellations” of hundreds or even thousands of tiny satellites.

Satellites have become so mainstream you can now buy a standard 4-in. by 4-in. “cubesat” kit online. All this activity could mean 20,000 to 40,000 satellites joining the 1,000 now in orbit over the next few years. “It’s quickly becoming congested,” Anderson said of the market for small-lift launch. Of the venture-backed rocket companies, SpaceX and Rocket Lab, with launch sites in New Zealand and Virginia, are making regular launches, although Richard Branson’s Virgin Galactic is scheduled to begin flying its manned shuttle this year.

The sky is also getting crowded. Aside from the thousands of new satellites scheduled for launch, there is already a lot of clutter in space — as many as 250,000 pieces of junk and debris circle the Earth. Up to now the U.S. Air Force has taken the lead role in tracking debris and warning satellite operators about possible collisions. But the military’s tracking radar, with some components dating back to the cold war, can only detect pieces 10 cm (4 in.) across or larger. LeoLabs, a start-up based in Menlo Park, California, has developed an advanced radar system that can detect objects in orbit as small as 2 cm (less than an inch) long.

A tiny object traveling at several thousand miles an hour can cause severe damage to a satellite. LeoLabs enables customers to track their small satellites more easily and to safely move them to a new position. “That will take a lot of the collision risks off the table,” says founder and CEO Dan Ceperley. His company has built phased array radars that steer the radar beam electronically — faster than a traditional dish antenna — in three locations: Alaska, Texas and New Zealand. To date, LeoLabs has raised $17 million from venture funds, including Marc Bell Capital Partners, Seraphim Capital and Space Angels.

Many of the 1,000 satellites now in orbit are engaged in observing Earth. They monitor the weather, humidity and temperature, among dozens of other phenomena, and capture millions of images. SkyWatch, based in Waterloo, Ontario, recently closed a $10 million round of funding led by San Francisco’s Bullpen Capital to develop its service to make satellite data easily available to companies.

SkyWatch would handle licensing and payment for data through subscription fees, and companies could use its software to build their own apps for tasks such as tracking crops or assessing damage from natural disasters. SkyWatch CEO James Slifierz compares his timing to the aftermath of the creation of the global positioning system infrastructure. Once GPS was in place, civilian applications followed.

The growing flow of data from satellites has raised concerns about data security. SpeQtral, based in Singapore, plans to build encryption keys based on the laws of quantum physics to protect space-to-Earth communications. “The security of any communications is essential,” says Chune Yang Lum, CEO of SpeQtral, which has raised a $1.9 million seed round led by Space Capital, the venture arm of Space Angels. Quantum encryption has been touted as practically unbreakable.

Start-ups don’t have a monopoly on developing new space applications. Tech giant Google has sought ways to commercialize its growing expertise in artificial intelligence and its vast computing power in the cloud. “We work with some of our largest and most transformative customers to do something epic,” said Scott Penberthy, director of applied AI at Google Cloud.

He said Google Cloud has done a number of projects with NASA’s Frontier Development Lab, including one that takes low-resolution photographs and combines them using AI to create a high-resolution image. Another proposal from Google would enable navigation on the moon’s surface (which has no GPS) by having AI comparing an astronaut’s surroundings with photos of the moon taken from space.

NASA is itself trying to benefit from the innovations brought by start-ups. In December, NASA’s Ames Research Center announced a deal with the Founders Institute, a renowned start-up accelerator, to make some of its technology available to start-up entrepreneurs. In September 2019 the space agency announced the latest round of its Tipping Point Program, a public-private initiative, was distributing $43.2 million to 14 American companies whose technologies could contribute to NASA’s plan for its Moon-to-Mars project. Participants include SpaceX, which will work on nozzles to refuel spaceships, and Blue Canyon Technologies, a Denver start-up developing autonomous navigation systems to enable small satellites to maneuver without communicating with “Earth.”

In the past five years, NASA has awarded five groups of Tipping Point Awards, worth more than $120 million combined. Broadly speaking, a company or project selected for a tipping point award receives NASA resources up to a fixed amount, with the private side paying for at least 25% of the program’s total costs. This allows NASA to shepherd the development of important space technologies while trying to save the agency money.

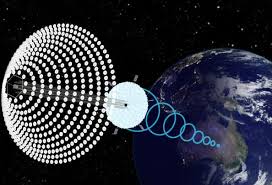

Despite the surge of cash, not all space projects find funding easily. John Mankins, a former NASA physicist, has long been an advocate of space-based solar power. Satellites would capture solar energy, convert it to microwaves and beam it down to Earth, where it would be converted into electricity. Mankins believes such a system taking advantage of recent technological advances can deliver electricity at a competitive price to areas of the world where power is expensive.

Mankins’ company, Solar Space Technologies, has formed a joint venture with an Australian company to seek funding to supply power to remote parts of Australia with minimum impact on the environment. While the cost for space-based solar power may have been prohibitive in the past, Dr. Michael Shara, an astrophysicist at New York’s Museum of Natural History, said “it really gets interesting” as costs come down.

Anderson, the Space Angels CEO, said venture capitalists hesitate to invest in space solar power because these are large infrastructure projects. “They require a significant amount of capex, and their paybacks are much longer than the typical 10-year lifetime of a venture capital fund.” But as concern about climate change increases and the cost of putting “stuff” in orbit drops, clean energy from space may become an attractive entrepreneurial proposition.